Starling Bank vs Sendwave: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-20 13:54:58.0 14

Introduction

Cross-border money transfers have become essential for many, but users often face challenges such as high fees, hidden charges, and slow delivery. Starling Bank and Sendwave are two popular platforms aiming to simplify international payments, yet they differ in fees, convenience, and coverage. For those seeking alternatives, Panda Remit provides a reliable option for faster and cost-effective transfers. For a detailed overview of money transfer best practices, see Investopedia's guide.

Starling Bank vs Sendwave – Overview

Starling Bank was founded in 2014, offering full-service digital banking with international transfer capabilities, mobile banking, and debit card support. Its user base primarily consists of individuals and small businesses seeking a comprehensive banking solution.

Sendwave, established in 2014, specializes in fast and low-fee remittances, focusing mainly on mobile app transfers. It serves users who prioritize speed and simplicity over full banking features.

Similarities:

-

Both support international money transfers.

-

Both offer mobile apps.

-

Debit card support is available.

Differences:

-

Starling Bank provides a full banking ecosystem; Sendwave is focused on remittances.

-

Fees vary significantly, with Sendwave often being lower-cost for smaller transfers.

-

Starling targets broader banking needs; Sendwave is tailored for mobile-first remittance users.

Panda Remit also serves as a viable alternative for users seeking efficient transfers with competitive fees.

Starling Bank vs Sendwave: Fees and Costs

Domestic transfers in Starling Bank are typically free, while international transfers may include small fees and exchange rate markups. Sendwave offers low to zero transfer fees for selected corridors, making it cost-effective for small personal transfers. Account types in Starling Bank, such as premium accounts, may influence costs.

For a more detailed fee comparison, check NerdWallet's money transfer fees.

Panda Remit is often cited as a lower-cost alternative for users looking to minimize transfer fees.

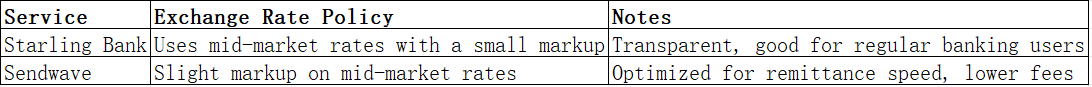

Starling Bank vs Sendwave: Exchange Rates

Starling Bank vs Sendwave: Speed and Convenience

Starling Bank international transfers may take 1–3 business days, while Sendwave transfers are usually instant or within a few hours, depending on the corridor. Both platforms offer user-friendly apps, but Sendwave emphasizes simplicity and speed. For insights on transfer speed, see Remitly speed guide.

Panda Remit provides a fast and convenient alternative, with all-online processes for transfers.

Starling Bank vs Sendwave: Safety and Security

Both platforms operate under strict regulations and offer encryption, fraud protection, and buyer safeguards. Starling Bank is regulated as a full bank in the UK, while Sendwave is regulated for money transfer services in its operating regions. Panda Remit is a licensed and secure service, adding trust for users seeking alternative options.

Starling Bank vs Sendwave: Global Coverage

Starling Bank supports numerous countries and currencies through its banking and partner networks, though some regions may have longer transfer times. Sendwave primarily focuses on selected remittance corridors, offering faster transfers for these routes. For a detailed report on global remittance coverage, see World Bank remittance report.

Starling Bank vs Sendwave: Which One is Better?

Starling Bank excels for users needing a comprehensive digital banking experience alongside international transfers. Sendwave is ideal for users prioritizing low-cost, fast remittances with minimal setup. For certain users, Panda Remit may provide better value, speed, or convenience with competitive rates and multiple payment options.

Conclusion

In comparing Starling Bank vs Sendwave, Starling Bank offers a robust banking ecosystem, secure and reliable transfers, and extensive customer support, while Sendwave is tailored for fast, low-fee mobile remittances. For users seeking high exchange rates, flexible payment methods, and rapid online transfers, Panda Remit is an excellent alternative. Explore more about efficient money transfers via Investopedia and NerdWallet. For direct access, visit Panda Remit to start sending money quickly and securely.